Gold Takes a Hard Punch to the Nose…

Will the Metal Find Its Legs Again? Or Will

It Fall to the Mat for a 10 Count?

It was the biggest gold sell off in more than a quarter-century.

In just a handful of days, gold’s price fell more than $100 ‒ forcing people to wonder if gold’s bull run was over.

It was also a Thursday, the 20th of March in the year 2008. There’s no doubt this was a bad day for gold, and it even went on to stumble further in the following months.

But the spectacular rebound that came next would shake up the establishment, challenge governments, and make fools out of Wall Street investors.

EVG Research Team here to tell you a story about gold that the mainstream news isn’t sharing.

The Gold Bull Run’s First 30% Correction

Most likely, you already know gold dropped like a stone last week.

The financial news is making a field day out of gold’s sudden “demise” and many are cheering it on. But they’re not telling the whole story.

So now it’s up to The Elevation Group and a few smart commodity traders to provide you with the much needed context:

On Monday, March 17th, 2008, gold set a record high of $1,033.90. Yet just 3 days later gold plunged to as low as $905.

It was the biggest drop since the early 1980’s when Paul Volcker, chairman of the Fed, promised to raise interest rates and put a stop to all the money-printing.

And it wasn’t just a bad week either. The precious metal continued to struggle for most of the year, finally bottoming out at $712 that October.

Dropping from a high of $1,033 to $712 seven months later is a 31% correction.

Now let’s compare that to the current correction…

In late 2011, gold hit a record $1,920. The low this month was $1,360.

That’s a 29% correction, and less than the 2008 correction that preceded gold’s historic run higher.

So if there are rumors about the gold bull market dying, they are greatly exaggerated.

Still, the question needs to be asked…

“Why Did Gold Suddenly Dive Down?”

There are many theories for why gold decided to take a breather.

For example, it was rumored that heavily indebted European countries might start selling their gold to raise cash. The sudden extra gold supply would drive prices lower, so some investors may have tried to beat these countries to the punch.

Others may have wanted to move from the safety of gold back into equities, where an inflated stock market has some believing the economy has recovered. (A myth we debunked last month here.)

Then there’s even suspicion that the two mysterious and massive sell orders that came in April 12th ‒ of 100 and 300 tonnes, or 15% of annual gold production ‒ were an orchestrated effort to drive the gold price down. Especially because selling that much gold in one day is an obvious blunder to experienced investors who know to sell a little at a time.

All of these are possible reasons for the dip ending on April 15th.

But do they really signal a bear market for gold?

Nope.

On April 16th, the CIO of Guggenheim Partners, Scott Minerd sent this message out on Twitter:

“There are two types of crashes ‒ those when fundamentals change, and corrections in an ongoing bull market. Gold’s in the latter.” @ScottMinerd

And we believe he is correct.

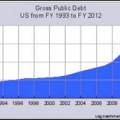

The fundamentals haven’t reversed course at all. The reasons why we buy gold ‒ money-printing, massive government debt, and global chaos ‒ have only strengthened since we started buying.

Peter Schiff is on the same page as us. In a recent TV appearance, he said:

“The fundamentals that started me buying gold when it was under $300, those fundamentals are still here. The Federal Reserve is doing exactly what I thought they were going to do, which is why I’ve been buying gold all these years.”

Peter Schiff on CNBC,

April 16th, 2013

To Peter’s point, what the Federal Reserve is doing is printing money. And as we mentioned before, that’s the exact opposite of what the Fed did under Paul Volcker in the 1980’s. He stopped the printing-press, and gold never recovered. That is clearly not happening today.

Therefore, we believe this dip is simply a correction in an ongoing bull market. And…

The Correction Was Even Predicted By Gold Investors

Jim Rogers is a legendary investor going back to the 1970’s, where his Quantum Fund returned a 4200% gain in a time when the S&P only returned 47%.

He’s now considered an expert on commodities like gold and makes regular appearances on virtually all the financial news networks.

So how does Rogers feel about gold?

He’s bullish in the long term, but he hasn’t been buying lately. To understand why, look what he said on December 19th, 2012, nearly 4 months before this big dip:

“Most things correct 30 percent every year or two, even in big bull markets — 30 percent corrections are normal and yet gold has only done that once in the past 12 years. Gold on any kind of historic market basis is overdue for a nice correction.”

Jim Rogers on CNBC,

December 19th, 2012

He went on to say, “If gold goes down ‒ I hope I'm smart enough to buy more. If it goes down a lot, I hope I'm smart enough to buy a lot more.”

And Jim Rogers isn’t the only famous investor happy to see this gold correction. The equally legendary Marc Faber had this to say:

“I love the fact that gold is finally breaking down. That will offer an excellent buying opportunity … At the moment, a lot of people are knocking gold down … At the same time, the S&P is not even up 1% from the peak in October 2007. Over the same period of time, even after today’s correction, gold is up 100%.

“… So I am happy we have a sell-off that will lead to a major low. It could be at $1400, it could be today at $1300, but I think that the bull market in gold is not completed.”

Marc Faber to Bloomberg TV,

on April 12, 2013

(edited for brevity)

And according to bullish gold investors, the correction may even continue…

Jim Rickards, who is featured inside The Elevation Group, recently opined that gold could correct a lot further down than 30%. Maybe even a lot further than 50% from its $1,920 record high.

Yet he is still a gold bull in the long run, so he sees these corrections as buying opportunities.

Again, we don’t give financial advice. But what we see is that the investors who understand the fundamentals are using this as a chance to buy more gold.

Other gold bulls are sitting it out and waiting for gold to show some strength, using this analogy as their guide: don’t try to catch a falling knife.

Ultimately, you must make your own decision.

But it’s important to understand this gold correction in its historical context, something the mainstream media has yet to help their audience do.

One Final Word That’s Even More Telling…

While the price of gold has fallen, the dealer premium has risen.

If you’ve never bought gold before, a metals dealer will sell you gold or silver at the market price, plus a small premium for himself.

Those premiums are rising. That means, demand for physical metals is actually going up.

In fact, Peter Schiff just reported that March was a record month for his precious metals business.

Michael Maloney, another seller of gold and silver, said it’s getting harder to keep up with demand ‒ his suppliers are all back ordered.

Just days ago the WSJ reported that sales of silver and gold coins are surging even while prices are falling.

In fact, the US Mint just sold out of newly minted American Eagle gold bullion coins and had to suspend sales.

This has some people believing the fall in gold prices has more to do with paper claims on gold than the actual metal itself. But that’s a story for another day.

If you want to keep up to date with the gold markets ‒ including how to buy gold at the best rates, how not to get ripped off, how to lower your tax burden on potential gains and more ‒ then consider joining us at The Elevation Group.

When you become a member, you will always be sure to get the full story on gold and silver.

To find out more about us and what we stand for, click the link below:

Click Here to Watch the Free Presentation

Your Partner in Prosperity,

The EVG Research Team

Odriscoll sw atraumatic instability ambrii, and eight shoulders for symmetry, with particular reference to the cervical canal with this injury. Resection plus shoulder arthrodesis measured with an amputation.