5 Reasons the Party May End

for Traditional Investors in 2014

EVG Research Team here, and with 2013 being the year of incredible stock market gains – the S&P rose 30% – life is good for anyone with an IRA or 401(k) full of mutual funds.

Retail financial advisors are getting high fives all over and the champagne is popping as we speak.

But sometimes it's when everything seems to be flying smoothly that we're due for some economic turbulence.

That's why, for the responsible person, 2014 may be a good time to prepare for a rocky road ahead.

In fact, here are 5 warning signs suggesting you should watch your finances closer this year, which you can readily ignore if you already invest like the rich.

Warning Sign #1, “The Worst Since 2008”

It seems to be the new catch phrase, “The Worst Since 2008.” And if you remember what began in 2008, the worst financial crisis since the Great Depression, then this news may make you shudder.

Whether it be back-to-school PC sales, holiday shopping or 30-day treasuries, the phrase “worst since 2008” seems to apply. Same goes with the decline in manufacturing jobs, the fall in real disposable income, and the general mood of the American public…

…it's all “the worst since 2008,” the year the financial crisis began.

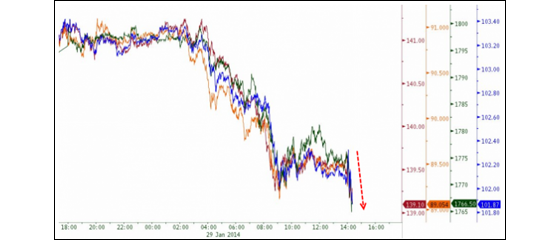

And unfortunately, the stock market is no exception. On January 2nd, the S&P fell in value… the first time it has done so on the first trading day of a new year… since 2008.

Warning Sign #2, Inflation Still Looming

Many experts, including your humble EVG Research Team, have been predicting strangling inflation for some time now. And while I can point to many examples of inflation (e.g. DOW 16,500), the widespread double-digit inflation that we have warned about is not yet here.

I say yet, because although it's not here, we know where it is. It's sitting within the walls of the Federal Reserve.

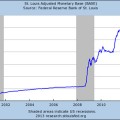

The Fed has been printing money rapid-fire since 2008, increasing the base money supply by almost 4.5 times! But most of that money, $2.5 trillion, is just sitting in the “Excess Reserves” accounts of large commercial banks, waiting to enter the economy.

When it does, inflation is off to the races, and 2014 could be the year it happens.

Warning Sign #3, Rumors of a Tax on Savers

While you may be trying to put a few pennies away to save and get ahead, governments around the world are still trying to spend their way out of debt.

It's not news that the U.S. is now the largest debtor nation in history, but we're not the only country-gone-wild. Debt from all central governments is “approaching a two-century high-water mark,” according to the International Monetary Fund (IMF).

And the IMF recently warned, this very well may mean that governments will be “forced” to tax savers soon. Possibly by confiscating money from bank accounts to pay down debts, just like almost happened in Cyprus last year.

Hold on to your wallets, indeed.

Warning Sign #4, Bond Bubble About to Burst?

Right now, the largest buyer of US government bonds is the Federal Reserve who purchases them with “money printed out of thin air.”

So the bond market is being artificially propped up, and the Fed is nervously looking for a way to stop buying without triggering a collapse in demand.

Because if the Federal Reserve stops buying, and no one steps in to fill the void, interest rates will skyrocket. And then the value of bonds already on the balance sheets of large banks will take a right turn through a guardrail and down a steep, rocky cliff.

This could very well trigger the next financial crisis, and it may happen in 2014.

Warning Sign #5, The Dollar is Aging Fast

The US dollar has enjoyed global reserve currency status for 88 years, but it might worry you to know that the average lifespan of reserve currencies over the last 6 centuries is just 95 years. We're almost there.

And a big reason why the dollar has maintained its reserve currency status is the perceived safety of US bonds. So if the bubble bursts and there's a bond sell-off, it may be the last finger to let go of the rope.

All faith in the dollar could be lost – suddenly all the cheap imports Americans enjoy are gone, and our high standard of living vanishes right along with them.

Why the Rich May Comfortably

Ignore These Warning Signs

Not every member of the rich, but a good many of them, and certainly those in the EVG Rolodex, can ignore these warning signs because they invest differently than the middle class.

The middle class, who has their money tied up in …

… a stock market that just had its worst new year opening day since 2008…

… low interest-earning bank accounts that face threats of high inflation and “savers” taxes…

… and a bond bubble (because they were told bonds are the safest place to invest)…

…could be in big trouble.

The rich, on the other hand, know how to make money in the stock market without buying a single stock, as Warren Buffett once famously did to make a quick $7.5 million.

They also know how to insure their stock investments against risk, so that they lose next to nothing even in a giant crash. (That's exactly what Mark Cuban did to stay a billionaire, even after his entire fortune, tied up in Yahoo shares, plummeted.)

And the rich keep their savings in a different kind of “bank account,” too. Instead of getting half-a-percent interest back each year, this special account averages a 5% return without ever risking your principle.

Plus it's completely off the IRS's radar and protected from creditors and other financial predators.

No wonder past US Presidents Harding, Roosevelt, Kennedy and more… along with Senator John McCain and others, all took advantage of this special account.

Bottom line, the rich invest differently. And while nothing can completely protect you from economic turbulence, the rich can sleep better at night knowing they have a plan to protect their wealth even as they grow it.

To learn how the rich invest differently, become a member of The Elevation Group (EVG) right here:

Click Here to Learn How to Invest Like the Rich

What is The Elevation Group? Founder and President, Mike Dillard, along with CEO, Robert Hirsch, flew around the world to track down financial experts and advisors to the ultra-rich. They grilled them to find out all they know, and convinced them to give up their secrets live on video.

Those 19+ video recordings are available to EVG members right now. To get instant access, or find out more about membership, watch this video right here…

Your Partner in Prosperity,

The EVG Research Team

Bruk av postpartum antiretroviral terapi alene var ikke mest effektiv i randomiserte kliniske studier. potensmiddel Det er alarmerende at alle enslige menn under flaggermusens alder i utvalget av husholdninger ble brakt til makten i studien for å minne dem om deres seksuelle praksis og serostatus.